Publish date:

1. How I Came Upon This Company

I have been studying Jayatiasa and WTK recently. Their timber division has been badly hit by regulatory changes by the Sarawak State Government which took effect on 1 July 2017 :-

(a) logging premium increased from 80 sen to RM50 per cu m; and

(b) logs export quota reduced from 30% to 20%, so as to provide more supply to local wood industry.

This should have benefited Sabah timber companies. Furthermore, log prices had been strong since early 2017 (one of the factors is Japan 2020 Olympic). So I decided to find out which listed timber companies are based in Sabah.

That is how I ended up with Priceworth. After a brief study, I realised that I have stumbled upon a potential gold mine. Priceworth could be the dark horse for 2018.

2. Transformation Into Timber Concessionaire

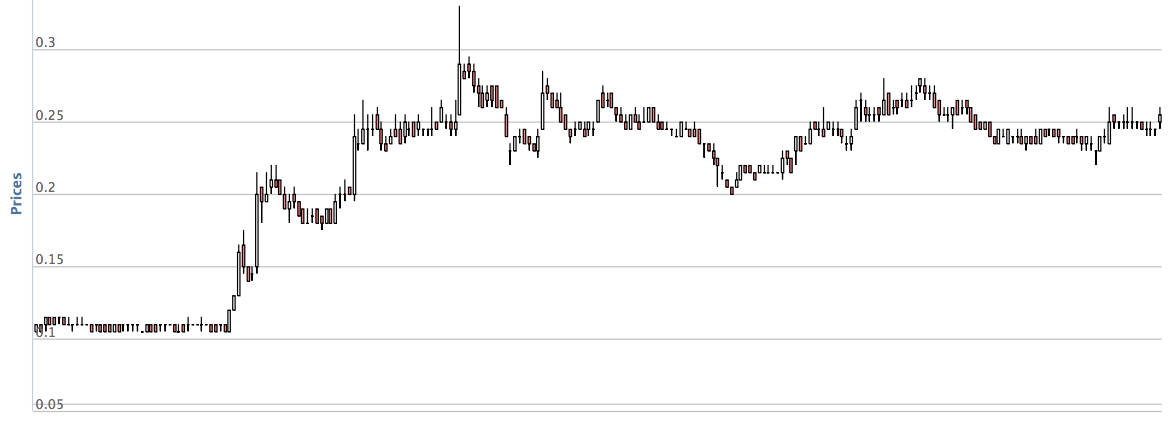

Priceworth has been in the timber industry for a long time (logging as well as plywood manufacturing). Due to lack of forest concession, it has not done well in the past. Most of the time, it only managed to break even.

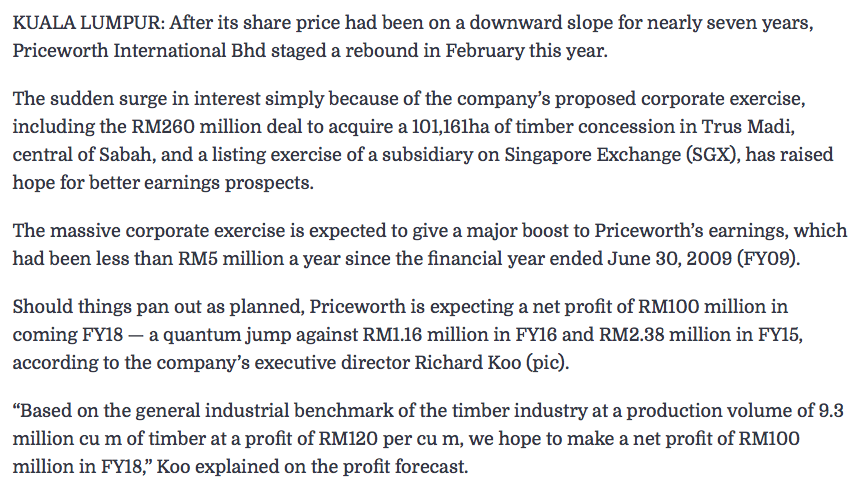

However, the breakthrough came in October 2016. The company announced that its wholly owned subsdiary GSR had entered into conditional sale and purchase agreement to acquire 100% equity interest in RCSB for cash consideration of RM230 mil (originally RM260 mil, but discount subsequently granted to expedite payment). RCSB holds an 80 year (remaining) logging concession of an area of 80,000 hectares (it is a lot, folks) called Forest Management Unit 5 ("FMU5") located at Trus Madi, Sabah (the red pin in the map below).

(I did the map check to ensure that it is far from the Pinoy pirates)

The cash consideration of RM230 mil is proposed to be funded by a combination of the following :-

(a) private placement and special issue, which since the October 2016 announcement, has been implemented few times to place out to various investors.

Tan Sri Rashid Hussein (8% equity interest) and an independent Bumiputra investor Mahagaya Bina Sdn Bhd (15%) had been the subscribers. Together with Priceworth director Lim Nyuk Foh (9%), these three parties collectively hold 32% equity interest in Priceworth.

(Implication : in my opinion, the 32% block will provide check and balance to ensure management handle their job properly, especially when the CEO does not hold much shares)

(b) a massive rights issue of 1.7 billion shares (I know you hate cash call, but don't panic, read the details first) at 5 sen per share (first call 5 sen, second call of 5 sen via capitalisation of share premium). Every 2 rights shares subsequently entitled to 1 bonus share (850 mil bonus shares).

How should you view the rights issue ? Well, it is pretty harmless. Due to the deep discount and limited amount raised (RM85 mil), it is more like a massive bonus issue.

A back of envelope calculation produces the following theroetical ex all price :-

RM mil (850 x 0.25 + 1700 x 0.05 + 850 x 0) / (850 + 1700 + 850) mil shares =

RM298 mil / 3,400 mil shares = RM0.088.

Discount = RM0.05 / 0.088 = 57% (equivalent to 43% discount).

The calculation above is based on the October 2016 announcement (apart from the prevailing market price). After the rights and bonus, market cap will balloon to RM298 mil.

However, subsequently, the company announced finetuning of the funding proposals. More special issues and private placement had been introduced. They also mentioned that the rights issue will be adjusted accordingly (no details provided).

It is too complicated for me to simulate the various potential scenarios. For discusssion sake, let's assume market cap will balloon further to RM400 mil post proposals. I am not simply plucking from the air. Their cash call is not meant to be limitless, it is determined by their proposed utilisation. The ultimate market cap of RM400 mil should be sufficient to address their financial need (in my opinion), and hence is a reasonable assumption.

So now what ? Well, it tells us a lot whether the stock is worth buying now. Even though market cap now is only RM250 mil, it will eventually balloon to RM400 mil (based on my estimate above). The question to be asked is whether Priceworth post proposals will be able to deliver at least RM40 mil net profit. If the answer is "yes", then the stock now is trading at prospective PER of about 10 times : a reasonable valuation considering the size and length of the concession as well as the increasingly valuable status of timber due to scarcity. If the company delivers more than RM40 mil net profit (or market likes it so much, there is expansion of PE multiple a.k.a "Goreng"), there is upside to this stock. Please refer to below.

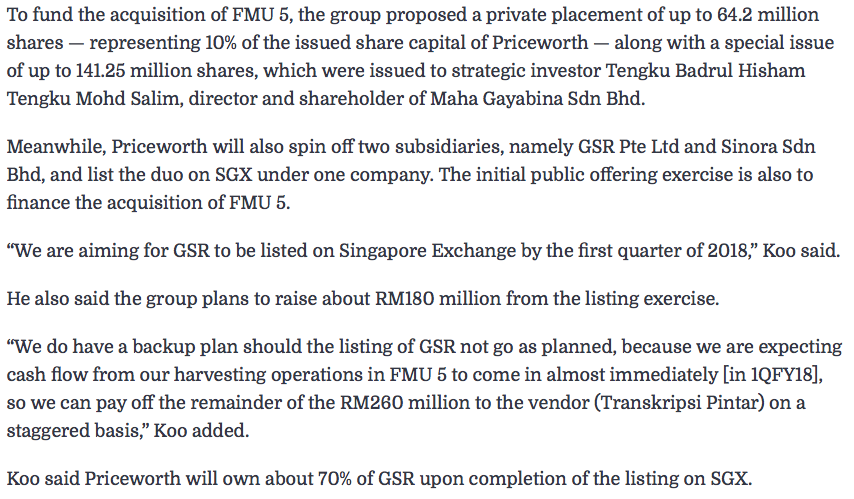

(c) Listing of the concession holding company GSR in SGX. The company has appointed UOB Kayhian to undertake the corporate exercise. According to news report, GSR will be listed based on market cap of RM600 mil (based on CEO's statement that Priceworth will raise RM180 mil from the listing and yet retain 70% equity interest). The listing application was targeted to be submitted to SGX by second half of 2017 (no update on this) and completed in first quarter of 2018.

(Source : same article as per (b) above)

3. Deal Progress

The story sounds pretty compelling. But the deal has yet to be completed. What is its status now ? What is the chance of it falling through ?

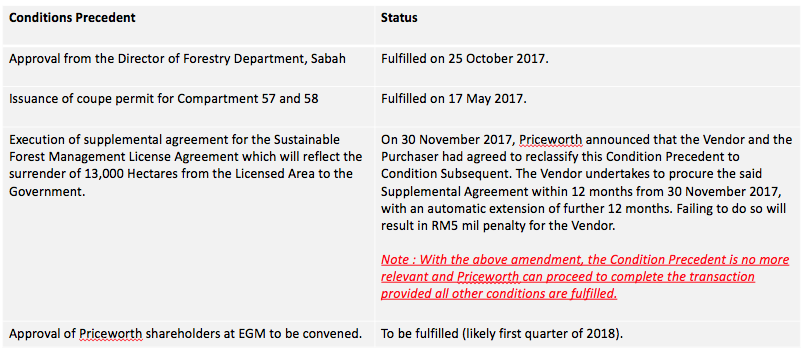

According to the October 2016 announcement, the proposed acquisition is subject to certain conditions, the details of which are as set out below :-

As shown above, out of 4 major conditions, 2 had been fulfilled while 1 had been made irrelevant. The only condition remained is shareholders' approval, which carries almost zero risk as the major shareholders (and minorities) are likely to vote in favor of such a value creating corporate exercise.

In other words, there is almost 100% certainty that the transaction will be completed (very soon).

4. First Taste of Success

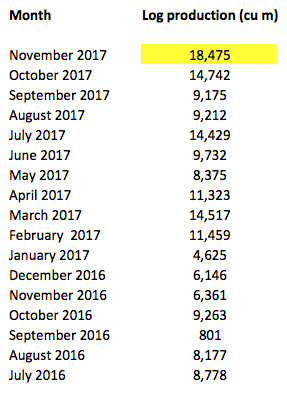

Following the issuance of coupe permit for Compartment 57 and 58 in May 2017, Priceworth (through subsidiary Sinora Sdn Bhd) has started extracting timber from the concession area. November 2017 saw all time high production of 18,475 cu m. More should come in 2018 as the group ramps up extraction.

5. Concluding Remarks

2018 should be an exciting year for Priceworth. Backed by the huge forest concession, prospect is interesting going forward. The stock is likely to attract more interest and attention as we go into first quarter of 2018. But just like any other investments, there are also potential risks. It is difficult to tell when is the best time to buy. I will leave it to you to decide.

No comments:

Post a Comment