Publish date:

1. Principal Business Activities

Lion Industries has three major business operation :-

(a) Amsteel Mill in Klang manufactures long products such as bars, rods, etc;

(b) Antara Steel Mill in Johor manufactures light sections such as angle bars, flat bars and U-channels; and

(c) Hot Briquetted Iron plant in Labuan which converts iron ore into HBI, a substitute for iron scrap.

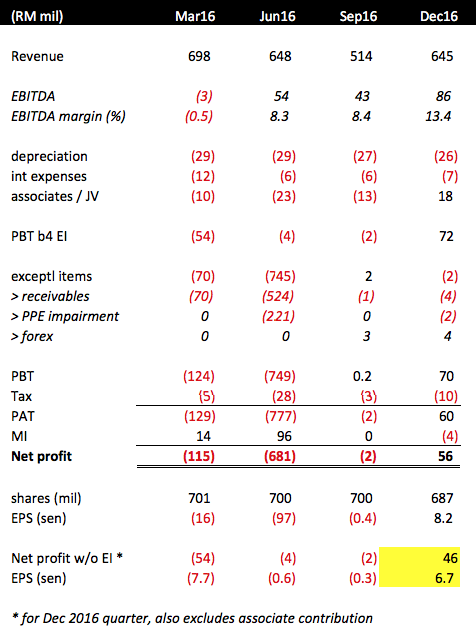

2. Strong December 2016 Quarter

On 23 February 2017, Lion Industries released a strong set of result for the quarter ended December 2016 (Note : March 2017 quarterly result yet to be announced).

Key observations :-

(a) Lion Industries' turnaround started in June 2016 quarter. Its EBITDA turned positive. However, due to huge impairment losses, the group reported huge loss of RM681 mil.

The impairment of receivables was mostly due to amount owing by Megasteel, which has since ceased operation. The group is not expected to register similar huge impairment going forward.

(b) The group's performance continued to stabilise in September 2016 quarter. With the absence of exceptional items, it broke even in that quarter.

(c) The group's performance improved substantially in the December 2016 quarter. Revenue grew while EBITDA margin widened susbtantially to 13.4%.

The company did not provide detailed explanation for the dramatic improvement. My guess is that it has benefited from higher iron ore price.

As shown in table above, during the quarter, iron ore price increased from USD55 per MT to USD80 per MT.

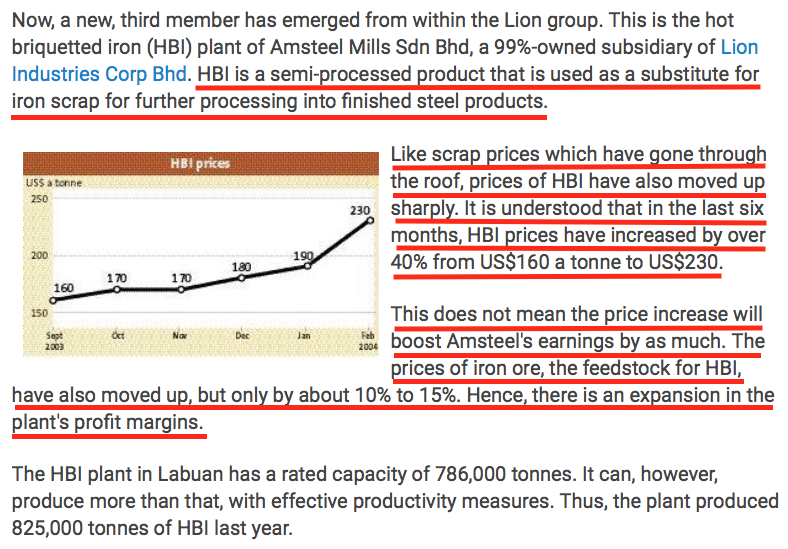

How would that benefit Lion Industries ?

This is because as iron ore price increases, scrap price also increases. The Hot Briquetted Iron ("HBI") produced by Lion Industries' Labuan plant is substitute for scrap. As such, its price will also go up.

Scrap price will usually increase faster than iron ore price as there is infinite amount of iron ore in the ground but supply of scrap is more limited.

As a result, when iron ore price goes up, even though Lion Industries' operating cost will increase, if the selling price of its HBI has gone up faster, it will be in a position to reap windfall gain.

I didn't cook up all these information. It was based on an article dated 2004 posted on The Star. The article might be a bit old, but the concept should still be valid.

(d) Lion Industries has a 23% stake in Parkson Holdings Bhd. In the December 2016 quarter, Parksons reported net profit of RM73 mil due to gain on disposal. This has resulted in RM18 mil positive contribution to Lion Industries' P&L. To be prudent, we should exclude this item.

(e) After making the necessary adjustments, Lion Industries' core earning for the December 2016 quarter should be RM46 mil, which translates into EPS of 6.7 sen.

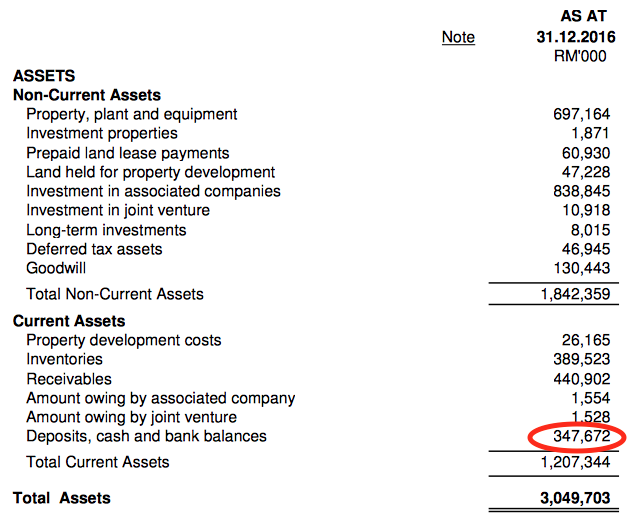

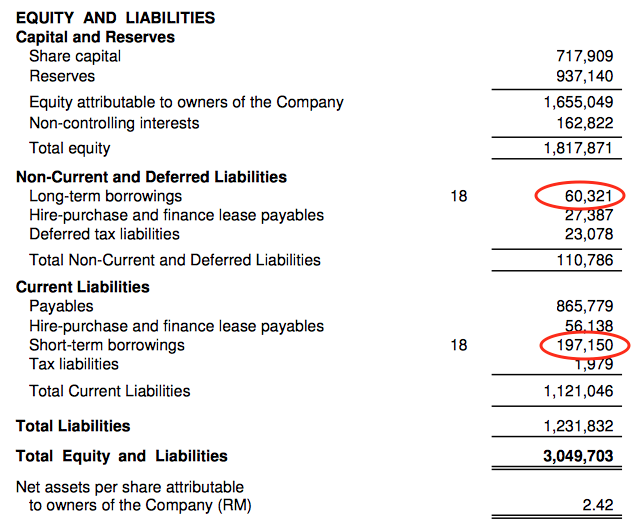

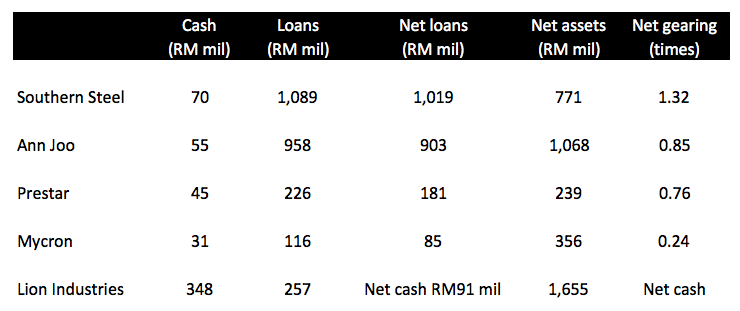

3. Surprisingly Strong Balance Sheets

I always have this impression that the Lion group of companies are mired in debt. I rubbed my eyes in disbelief when I went through Lion Industries' balance sheets. The group has net cash of RM91 mil !!!

Compared to other industry players, Lion Industries' balance sheet is considered very strong.

With such balance sheet strength, the group is in position to pay out high dividend now that it has returned to profitability. Will it do so ? We will soon find out in coming quarters.

4. What To Expect In Coming Quarter ?

I am cautiously optimistic about the coming quarter's result. Iron ore price remained strong in the three months ended March 2017 (major correction started in April 2017). If my hypothesis in Section 2 above is correct, the group's HBI division should continue to do well.

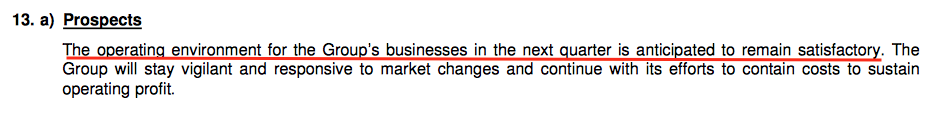

In the December 2016 quarterly report, this is what management said about prospects :

(Source : December 2016 quarterly report)

To have a feel of whether management was serious about what they said, or they simply put in something to entertain shareholders, I dug out past few quarters' commentaries on prospects.

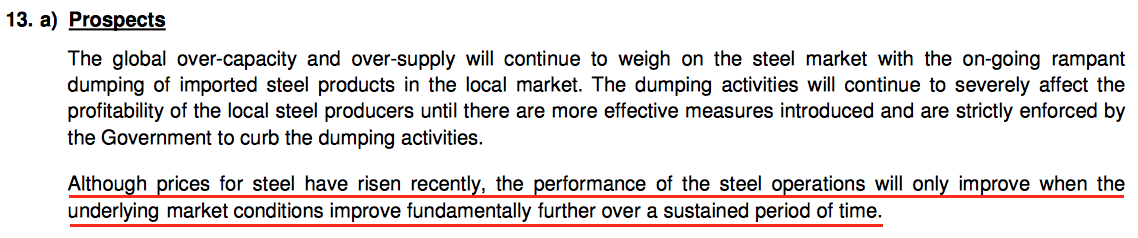

(Source : March 2016 quarterly report)

(Source : June 2016 quarterly report)

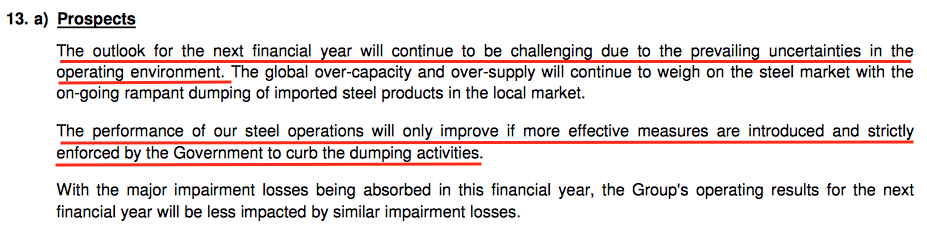

(Source : September 2016 quarterly report)

Well, I would say that managment passed my little test with flying colour. Everything they said in the past 3 quarters closely reflected what followed subsequently.

In March and June 2016 quarters, they cautioned that operating environment remained challenging, and the results subsequently validated what they said.

In September 2016 quarter, they guided for better performance and that was exactly what happened when December 2016 result was revealed.

It seemed that they were quite careful with their words. What do you think ?

5. Should We Worry About June 2017 Quarter ?

If you take a careful look at the iron ore chart in Section 2 above, you will notice that iron ore price has declined substantially in April 2017. How will that affect Lion Industries' profitability ? Should we be concerned ?

In my opinion, the decline should result in lower profitability at HBI division (no more windfall gain). However, Lion Industries' milling division (Amsteel mill and Antara mill) should benefit from lower input cost.

The steel industry is very complicated. It is affected by many factors which changed from time to time. I simply don't have the resources and expertise to predict how the group will perform in the June 2017 quarter.

However, I believe the group will still report healthy profit. Southern Steel does not have an HBI division to benefit from. However, in the latest March 2017 quarter, it still reported a sterling set of result (even when scrap price was so high). With stronger balance sheets (and hence lower interest expenses), there is no reason to believe that Lion Industries cannot achieve the same performance going forward.

6. Ann Joo's Pretension

In its latest annual report, Ann Joo bragged profusely about its blast furnace (it also has electric arc furnace, just like everybody else). Most steel players use scrap as raw matertial. When scrap price is high, Ann Joo's blast furnace provides it with the flexibility to switch to iron ore, which is usually cheaper.

Because of that, recently Ann Joo's share price has run ahead of other industry players - the Ann Joo Premium.

Sorry to burst your bubble, Ann Joo. Looked like you are not the only one with that flexibility. Lion Industries' HBI plant serves the same purpose. Furthermore, Lion Industries' balance sheets is much stronger than you.

How about some Lion Premium, huh ?

(I put in the above for fun. Ann Joo shareholders please don't be offended)

7. Concluding Remarks

I am relatively late to the steel industry re-rating. There were previously many uncertainties that stopped me from putting serious money in the sector. However, the government recently imposed a 3 year anti dumping duty on foreign steel import. With that, the industry's operating environment has improved substantially. I believe we are far from approaching the end of the positive cycle and it is still not late to take position.

Lion Industries attracted my attention because of its strong core EPS of 6.7 sen in previous quarter. At current price of RM1.00, even if EPS halved in subsequent quarters, I believe the stock will not collapse in a big way.

It also has strong balance sheet. With a bit of luck, shareholders might even enjoy some dividend going forward.

After taking into consideration the above, I would like to nominate Lion Industries as the TOP PICK for steel play.

Target price of RM1.50 by end 2017.

No comments:

Post a Comment