Publish date:

Reason 1 - Meets Requirement of KYY Golden Rule

HSL is a Sarawak based civil and marine contractor.

In 2016, the group secured RM1.9 billion new contracts (70% of Pan Borneo Highway and Kuching Centralised Wastewater Management Project).

In March 2017, the group secured RM333 mil wastewater treatment project in Miri, Sarawak.

As at todate, the group's outstanding order book is RM2.5 billion.

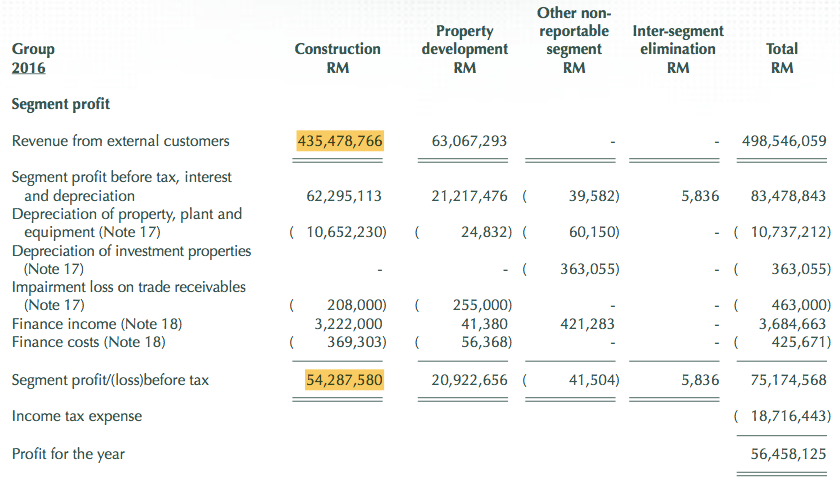

In FY2016, the group's construction revenue was RM435 mil. The existing order book is 5.7 times that figure (analysts expect it to last at least three years once ramped up).

In other words, earning visibility is very good.

Reason 2 - Good Time Is Just Around The Corner

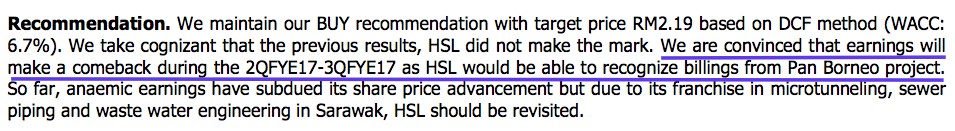

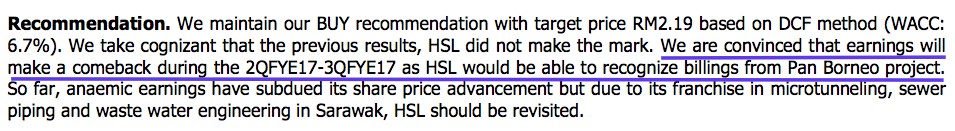

MIDF's analyst visited the company recently (27 April 2017). Based on management guidance, earning from new contracts should start showing up in Q2 / Q3.

https://cdn1.i3investor.com/my/files/dfgs88n/2017/04/27/1505930921-361785338.pdf

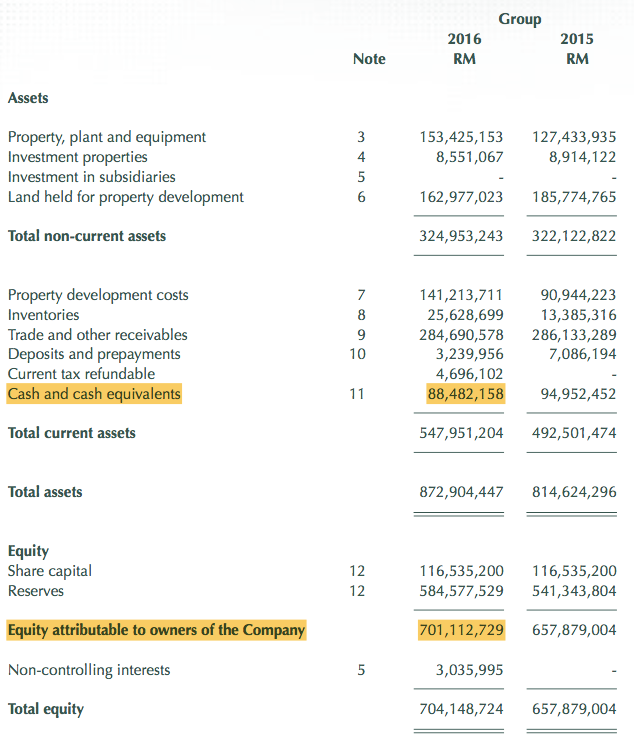

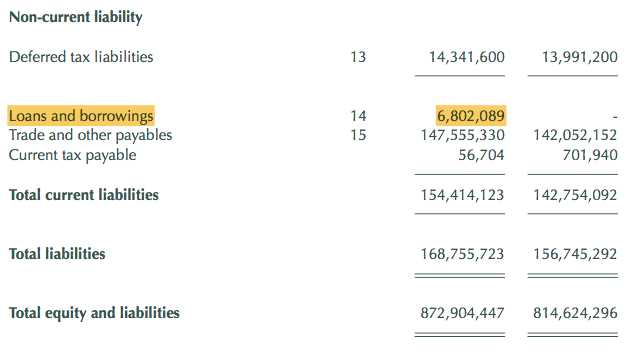

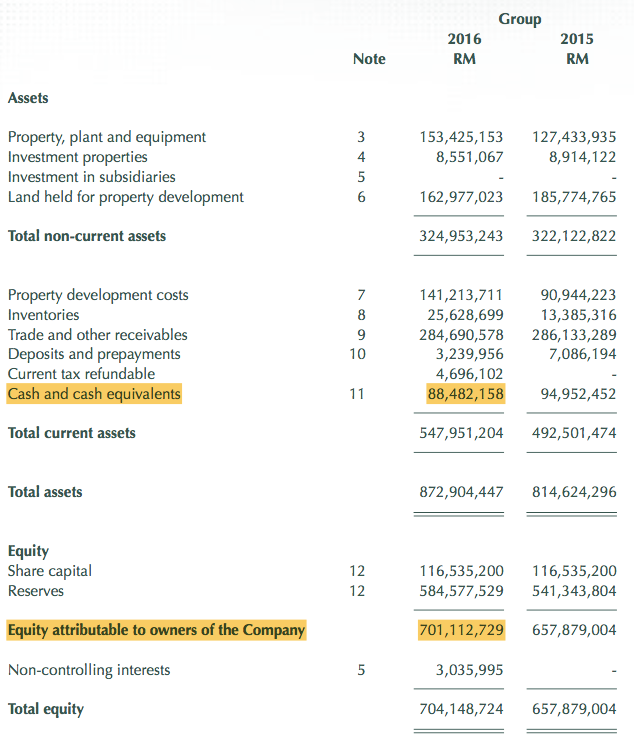

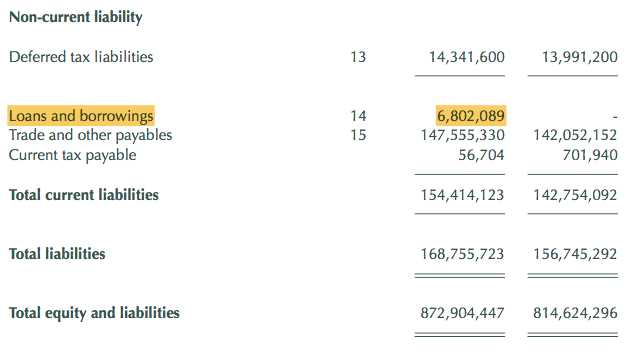

Reason 3 - Strong Balance Sheets

The group is in net cash position. Please refer to information below, which is self explanatory.

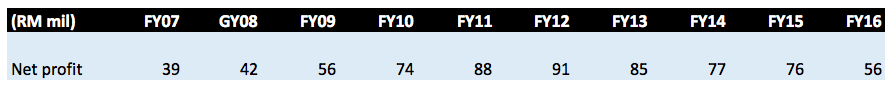

Reason 4 - Impeccable Track Record

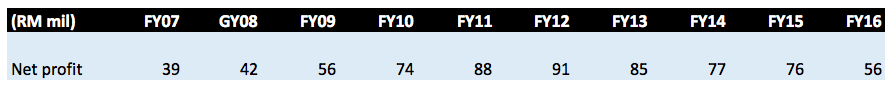

Talk no use. Let facts show how well the company has been run in the past.

As shown in table above, even during 2007 / 2008 crisis, the group managed to report growing profit.

Reason 5 - No Legacy Issues

The group is squeaky clean. There are no legacy issues that will act as a drag on the group going forward.

There is currently a court case between shareholders. But it is more related to dispute of shareholding instead of over direction of the group. In my opinion, it should not have material impact on the group.

Reason 6 - Still Trading At All Time Low

Market is frothy now. Go defensive. Buy something that has not gone up much.

HSL is now trading at 10 sen above its past two years all time low of RM1.60. Barring a market meltdown, I think there is limited downside.

Reason 7 - Relatively Small Market Cap

Market cap is only RM1 billion. There is plenty of room for growth, especially for a group with such strong earning visibility.

Reason 8 - Potential Additional Contracts

One of the main reasons the stock has not moved much is because analysts have been making conservative forecast of their FY2017 earning.

Even though I frequently complain about analysts' conservative bias to safeguard their reputation, I am not really in a position to dispute their figures.

However, in my opinion, earning is not the only catalyst. The group is very likely to secure further contracts in the next few months. If that happens, we will not be able to get the shares at such bargain price.

It is always good to move one step ahead of others.

Reason 9 - Efficient Management Team

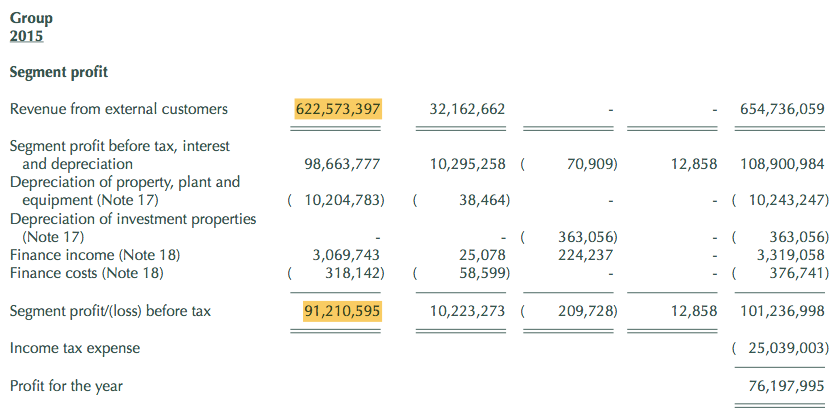

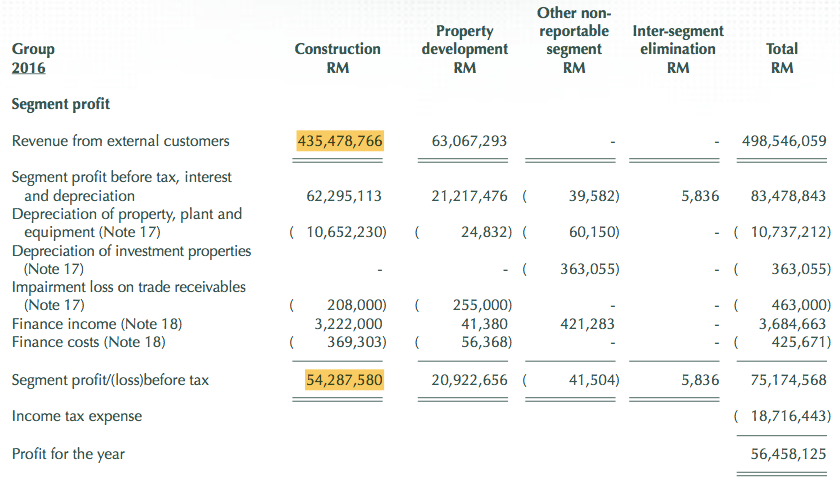

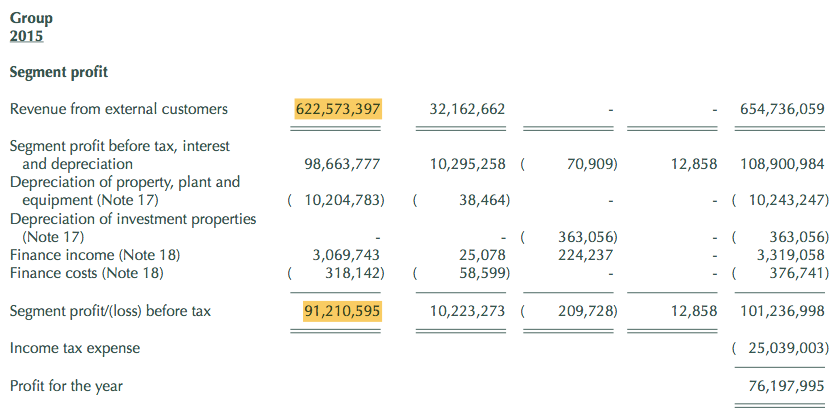

In FY2016, the PBT margin of the group's construction division was 12%. Assuming tax rate of 25%, net margin worked out to be 9%. Based on my experience, normal construction net margin was 5%. As such, HSL's margin is quite impressive.

(In FY2015, construction PBT margin was 15%, which worked out to be 11% net margin).

Reason 10 - TA Signal Has Turned Bullish

I am an FA guy, but I do know a little bit of TA. After studying various TA methods in the past one year, I have identified MACD Zero Line Crossing as the most reliable (I am not particularly fond of Signal Line Crossing as it carries too much noise).

In HSL's case, MACD has recently crossed the Zero Line. For me, it is a Buy signal.

HSL is a Sarawak based civil and marine contractor.

In 2016, the group secured RM1.9 billion new contracts (70% of Pan Borneo Highway and Kuching Centralised Wastewater Management Project).

In March 2017, the group secured RM333 mil wastewater treatment project in Miri, Sarawak.

As at todate, the group's outstanding order book is RM2.5 billion.

In FY2016, the group's construction revenue was RM435 mil. The existing order book is 5.7 times that figure (analysts expect it to last at least three years once ramped up).

In other words, earning visibility is very good.

Reason 2 - Good Time Is Just Around The Corner

MIDF's analyst visited the company recently (27 April 2017). Based on management guidance, earning from new contracts should start showing up in Q2 / Q3.

https://cdn1.i3investor.com/my/files/dfgs88n/2017/04/27/1505930921-361785338.pdf

Reason 3 - Strong Balance Sheets

Reason 4 - Impeccable Track Record

Talk no use. Let facts show how well the company has been run in the past.

As shown in table above, even during 2007 / 2008 crisis, the group managed to report growing profit.

Reason 5 - No Legacy Issues

The group is squeaky clean. There are no legacy issues that will act as a drag on the group going forward.

There is currently a court case between shareholders. But it is more related to dispute of shareholding instead of over direction of the group. In my opinion, it should not have material impact on the group.

Reason 6 - Still Trading At All Time Low

Market is frothy now. Go defensive. Buy something that has not gone up much.

HSL is now trading at 10 sen above its past two years all time low of RM1.60. Barring a market meltdown, I think there is limited downside.

Reason 7 - Relatively Small Market Cap

Market cap is only RM1 billion. There is plenty of room for growth, especially for a group with such strong earning visibility.

Reason 8 - Potential Additional Contracts

One of the main reasons the stock has not moved much is because analysts have been making conservative forecast of their FY2017 earning.

Even though I frequently complain about analysts' conservative bias to safeguard their reputation, I am not really in a position to dispute their figures.

However, in my opinion, earning is not the only catalyst. The group is very likely to secure further contracts in the next few months. If that happens, we will not be able to get the shares at such bargain price.

It is always good to move one step ahead of others.

Reason 9 - Efficient Management Team

In FY2016, the PBT margin of the group's construction division was 12%. Assuming tax rate of 25%, net margin worked out to be 9%. Based on my experience, normal construction net margin was 5%. As such, HSL's margin is quite impressive.

(In FY2015, construction PBT margin was 15%, which worked out to be 11% net margin).

Reason 10 - TA Signal Has Turned Bullish

I am an FA guy, but I do know a little bit of TA. After studying various TA methods in the past one year, I have identified MACD Zero Line Crossing as the most reliable (I am not particularly fond of Signal Line Crossing as it carries too much noise).

In HSL's case, MACD has recently crossed the Zero Line. For me, it is a Buy signal.

No comments:

Post a Comment