Publish date: Wed, 18 May 2016, 09:08 PM

1. Sterling Set of Results

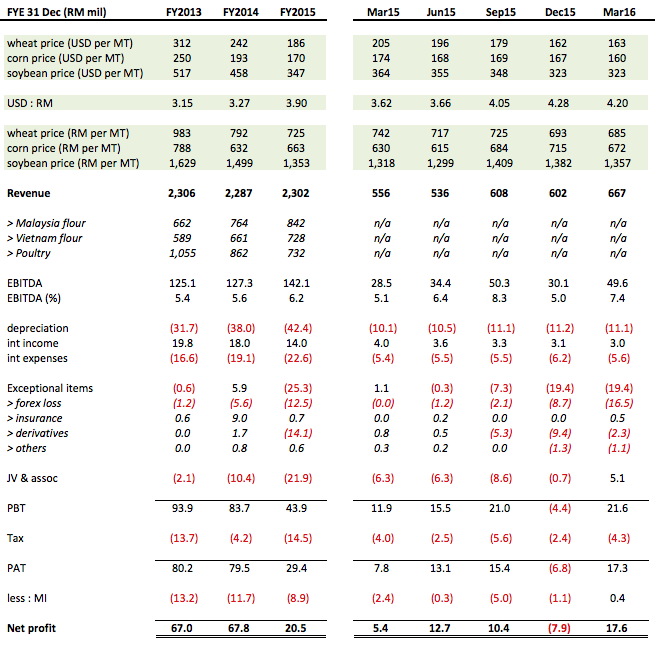

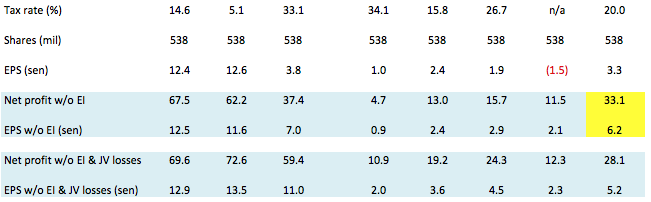

On 17 May 2016, MFM released its quarterly report for the three months ended 31 March 2016. EPS came in at 3.3 sen. However, there were forex losses and other exceptional items amounted to RM19.4 mil. Without those items, latest quarter EPS will be as high as 6.2 sen (please refer to yellow highlighted section in P&L table below).

2. Principal Business Activities

According to the company's website, it is involved in the following business activities :-

(i) Flour milling

MFM owns 70% of the Vietnamese subsidiary. The Vietnam flour operation is quite huge. Its turnover is almost the same as that in Malaysia at approximately RM700 mil plus per annum.

(ii) Integrated Poultry

The poultry subsidiaries are 100% owned.

(iii) Feed Milling

MFM owns 70% and 100% equity interest in Dinding Soya & Multifeeds Sdn Bhd and MFM Feedmill Sdn Bhd respectively.

(iv) Raw Material Trading

MFM owns 51% equity interest in Premier Grain Sdn Bhd, which is involved in trading of raw materials for animal feed. The remaining 49% is owned by Toyota.

(v) Flour Mill In Indonesia

MFM owns 30% equity interest in PT Bungasari Flour Mills Indonesia. Its factory is located at a port near Jakarta.

PT Bungasari commenced operation in second half of 2014 with revenue of RM66 mil. In FY2015, revenue has increased to RM392 mil. Management is very bullish about PT Bungasari's propsects due to Indonesia's huge population :-

3. Historical P&L

MFM has been consistently profitable. Being in the food industry, its business is resilient and not susceptible to economic cycles. In normal years, its net profit ranged from RM67 mil to RM85 mil (EPS between 12.5 sen and 15.8 sen).

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY |

|---|---|---|---|---|---|---|

| 2015-12-31 | 2,301,907 | 20,545 | 3.82 | 34.56 | 4.00 | 3.03 |

| 2014-12-31 | 2,286,575 | 67,778 | 12.59 | 12.32 | 6.50 | 4.19 |

| 2013-12-31 | 2,306,038 | 66,978 | 12.44 | 12.22 | 9.00 | 5.92 |

| 2012-12-31 | 2,028,475 | 28,511 | 6.07 | 21.09 | 3.00 | 2.34 |

| 2011-12-31 | 1,918,415 | 80,872 | 25.04 | 14.38 | 62.00 | 17.22 |

| 2010-12-31 | 1,555,091 | 84,824 | 78.80 | 2.83 | 26.00 | 11.66 |

Further details of the group's historical P&L are as set out below :-

Key observations :-

(a) Despite weakening of Ringgit vs. USD, raw material cost in FY2015 has actually declined compared to FY2014 as interntional commodity prices (based on USD) has dropped substantially.

(b) This showed up in the group's EBITDA margin, which improved from 5.6% in FY2014 to 6.2% in FY2015.

(c) The group derived one third of its revenue from Malaysia flour milling, Vietnam flour milling and poultry operation (Malaysia) respectively.

(d) In March 2016 quarter, the group's revenue increased substantially. Management attributed that to higher flour / grain trading revenue.

(e) The group has actually done quite well in first three quarters of FY2015 (Q1, 2 and 3). However, total losses of RM21.2 mil at 30% owned PT Bungasari dragged down the group's performance.

(f) In Q4 of FY2015 and Q1 of FY2016, the Indonesian JV was no more loss making. However, it was forex and derivative losses' turn to drag down the group's performance. Total losses of those exceptional items added up to approximately RM39 mil in that two quarters.

4. Balance Sheets

Based on net assets of RM756 mil, cash of RM273 mil and loans of RM814 mil, net gearing is 0.72 times.

Out of RM814 mil loans, RM448 mil is denominated in USD (55%).

91% of the group's borrowings are Bankers' Acceptances (BA). This is not surprising as it imports most of its raw material.

The high amount of trade financing did not seem to have major adverse impact on profitability. Total interest expenses and income in FY2015 was RM23 mil and RM14 mil respectively. The net amount was hence only RM9 mil, vs. EBITDA and net operating profit of RM142 mil and RM60 mil respectively.

This was because the Bankers' Acceptance bears low interest rate of 3% only.

As mentioned in my previous articles (Comcorp, etc), I am not particularly alarmed by BA and other trade financing. As long as the group manages its receivables well, these facilities can be a cheap and sustainable way to finance operation.

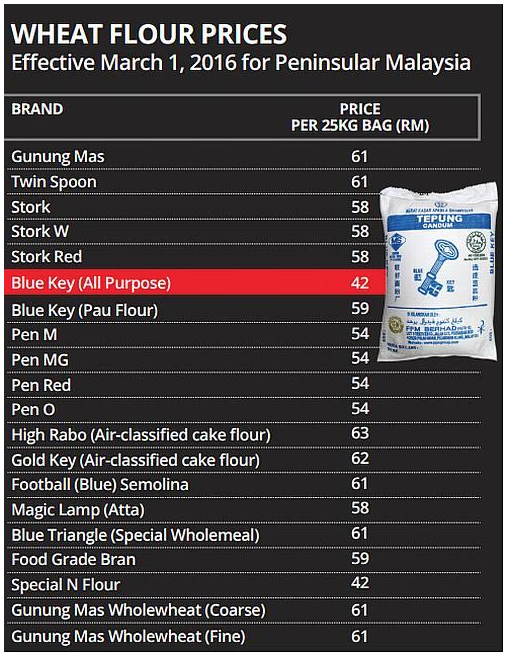

5. Liberalization of Domestic Flour Market

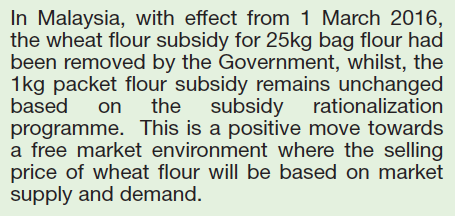

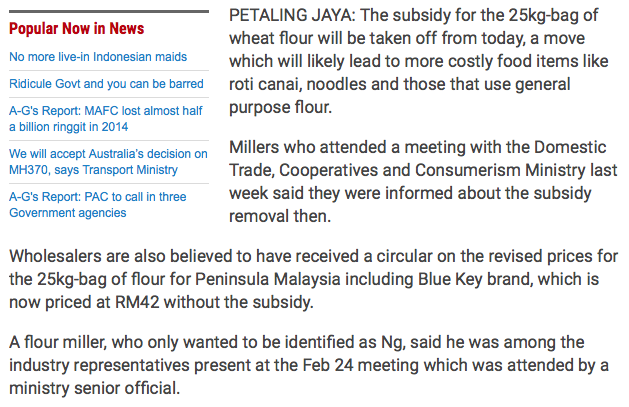

According to the company, from 1 March 2016 onwards, domestic flour price will be allowed to fluctuate.

According to the paragraph above extracted from FY2015 annual report, the company is apparently quite please with this latest development.

I don't really understand how the whole thing work. My guess is that it will give them flexibility to pass over higher raw material cost to consumers when necessary.

6. Conlcuding Remarks

(a) One famous investor once said "if you don't own the stock, you will never understand it". It is actually very true. MFM has been on downward trend since September 2014. However, I never bother to look at it carefully. I always have this impression that since MFM imports the bulk of its its raw material, it is a foregone conclusion that it will not be able to do well in the current weak Ringgit environment.

However, as today's study showed, things are not as I thought - despite weakening of Ringgit, the sharp decline of international commodity prices has resulted in import cost that is lower than previous years.

As a result, MFM has actually done quite well in FY2015 (excluding the exceptional items).

(b) There is not sufficient information to tell whether the latest quarter's strong result can be repeated going forward. However, the turning around of Indonesia joint venture is an important milestone.

In the March 2016 quarter, the Indonesia JV contributed RM5 mil to net profit. If annualised, the additional RM20 mil could potentially propel the group's profitability to a level never seen before.

Will this happen ? We will have to wait for next few quarters to find out.

Appendix

GPS robot tripled the $100k deposit [live proof]

ReplyDeleteI just got done with a webinar with Mark and his partner, Antony, two days ago and it was GREAT.

During the webinar Mark and Antony shared their tips to success and answered questions about their new version of the GPS Forex Robot that came out TODAY!