Author: Icon8888 | Publish date: Sat, 16 Jul 2016, 12:17 PM

1. Introduction

I am not particularly interested in BJ Toto. It is too well understood, trading at relatively high PER and not high beta enough. The reason I write about it is because it is part of Berjaya Corp Group ("BJ Corp").

As mentioned in my previous article, I am analysing BJ Corp like I am peeling an onion. By understanding BJ Toto, I will be able to better understand BJ Land. By understanding BJ Land, I hope to better understand BJ Corp.

2. Historical Profitability

During the period from FY2010 to FY2015, BJ Toto reported average net profit of RM370 mil (EPS of approximately 28 sen) and it traded at average PER of 14 times. It used to trade as high as RM4.50.

However, due to a confluence of factors, the group's net profit declined by 18% to RM306 mil in FY2016. Share price also retraced by 36% to as low as RM2.86.

As at the date of this article, the stock closed at RM3.21, which translates into PER of approximately 14 times based on EPS of 22.7 sen.

Based on latest closing price and 1.35 billion shares, its market cap is approximately RM4.3 billion.

Berjaya Land holds 540 mil shares in BJ Toto, representing equity interest of 40%. The 40% stake is worth RM1.73 billion based on BJ Toto's latest closing price of RM3.21. (Note : at all time high of RM4.50, the stake will be worth RM2.4 billion)

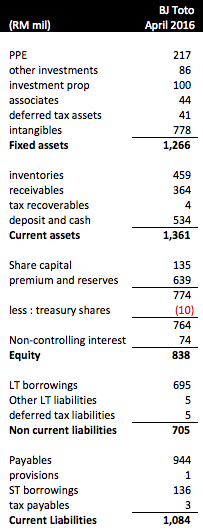

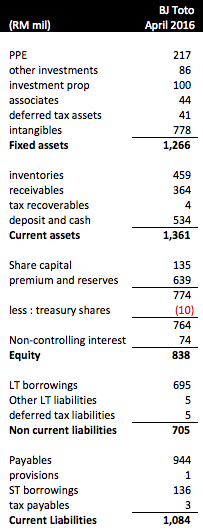

3. Balance Sheet

BJ Toto is asset light. The bulk of its assets are commercial properties (shop lots ?) and Toto related equipments.

Due to heavy dividend payment, its net assets per share is only 56 sen (PBR of 5.7 times).

Based on total loans of RM831 mil, cash of RM534 mil and shareholders' funds of RM764 mil, its net gearing is 0.39 times.

Anyway, Balance Sheet does not paint a clear picture of BJ Toto's financial position. Its strength is in its cash flow, further details of which are as set out below.

4. Cash Flow

Key observations :-

(a) During the past 4 years, the group generated average net operating cash flow of approximately RM400 mil per annum.

(b) On average, it spent approximately RM100 mil per annum on capex and investment.

(c) After servicing interest payment of approximately RM50 mil, the company has been paying out approximately RM250 mil dividend to shareholders per annum.

(d) After all the above activities, the group's average net cash flow is approximately RM30 mil per annum (break even).

5. Concluding Remarks

(a) In the 1990s, BJ Toto was the darling of foreign funds. Investors liked the group for its strong cash flow. However, over the years, it has fallen out of favour with new generation of investors. Nowadays, the stock does not generate the same level of excitement as before. People bought it for its dividend yield.

(b) I am neutral about the stock. At current price, I think it is undervalued. However, I am giving it a pass due to its unexciting growth prospects (observant readers will notice that I am contradicting myself by making a Buy call for Magnum recently. Guilty as charged).

(c) As mentioned in Introduction section, I write about BJ Toto as part of my analysis of the BJ Corp group. I target to publish my BJ Land article next week. Watch this space.

Have a nice day.

I am not particularly interested in BJ Toto. It is too well understood, trading at relatively high PER and not high beta enough. The reason I write about it is because it is part of Berjaya Corp Group ("BJ Corp").

As mentioned in my previous article, I am analysing BJ Corp like I am peeling an onion. By understanding BJ Toto, I will be able to better understand BJ Land. By understanding BJ Land, I hope to better understand BJ Corp.

2. Historical Profitability

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS |

|---|---|---|---|---|---|---|---|

| 2016-04-30 | 5,563,229 | 306,183 | 22.70 | 13.40 | 19.00 | 6.25 | 0.5700 |

| 2015-04-30 | 5,283,644 | 361,610 | 26.86 | 12.14 | 21.50 | 6.60 | 0.5100 |

| 2014-04-30 | 4,340,839 | 328,706 | 24.66 | 15.78 | 26.50 | 6.81 | 0.4600 |

| 2013-04-30 | 3,628,362 | 391,085 | 29.43 | 14.28 | 28.00 | 6.67 | 0.4200 |

| 2012-04-30 | 3,607,754 | 405,476 | 30.37 | 13.93 | 27.00 | 6.38 | 0.3600 |

| 2011-04-30 | 3,433,216 | 349,761 | 26.15 | 15.80 | 21.00 | 5.08 | 0.3400 |

| 2010-04-30 | 3,392,810 | 383,504 | 29.02 | 15.41 | 57.50 | 12.86 | 0.3400 |

During the period from FY2010 to FY2015, BJ Toto reported average net profit of RM370 mil (EPS of approximately 28 sen) and it traded at average PER of 14 times. It used to trade as high as RM4.50.

However, due to a confluence of factors, the group's net profit declined by 18% to RM306 mil in FY2016. Share price also retraced by 36% to as low as RM2.86.

As at the date of this article, the stock closed at RM3.21, which translates into PER of approximately 14 times based on EPS of 22.7 sen.

Based on latest closing price and 1.35 billion shares, its market cap is approximately RM4.3 billion.

Berjaya Land holds 540 mil shares in BJ Toto, representing equity interest of 40%. The 40% stake is worth RM1.73 billion based on BJ Toto's latest closing price of RM3.21. (Note : at all time high of RM4.50, the stake will be worth RM2.4 billion)

3. Balance Sheet

BJ Toto is asset light. The bulk of its assets are commercial properties (shop lots ?) and Toto related equipments.

Due to heavy dividend payment, its net assets per share is only 56 sen (PBR of 5.7 times).

Based on total loans of RM831 mil, cash of RM534 mil and shareholders' funds of RM764 mil, its net gearing is 0.39 times.

Anyway, Balance Sheet does not paint a clear picture of BJ Toto's financial position. Its strength is in its cash flow, further details of which are as set out below.

4. Cash Flow

Key observations :-

(a) During the past 4 years, the group generated average net operating cash flow of approximately RM400 mil per annum.

(b) On average, it spent approximately RM100 mil per annum on capex and investment.

(c) After servicing interest payment of approximately RM50 mil, the company has been paying out approximately RM250 mil dividend to shareholders per annum.

(d) After all the above activities, the group's average net cash flow is approximately RM30 mil per annum (break even).

5. Concluding Remarks

(a) In the 1990s, BJ Toto was the darling of foreign funds. Investors liked the group for its strong cash flow. However, over the years, it has fallen out of favour with new generation of investors. Nowadays, the stock does not generate the same level of excitement as before. People bought it for its dividend yield.

(b) I am neutral about the stock. At current price, I think it is undervalued. However, I am giving it a pass due to its unexciting growth prospects (observant readers will notice that I am contradicting myself by making a Buy call for Magnum recently. Guilty as charged).

(c) As mentioned in Introduction section, I write about BJ Toto as part of my analysis of the BJ Corp group. I target to publish my BJ Land article next week. Watch this space.

Have a nice day.

No comments:

Post a Comment