Author: Icon8888 | Publish date: Sat, 30 Jul 2016, 02:41 PM

1. Introduction

Yesterday, CIMB Niaga released its June 2016 quarterly report. There was marked improvement in results. Net profit increased by 74% Q-o-Q.

(Press release spinned it as 318% increase Y-o-Y. However, I think Q-o-Q is more reflective of its latest earning momentum)

2. Results Analysis

(a) Compared with previous quater, net profit increased by 74% to Rp467 bil.

(b) One of the major positive contributor is Net Interest Income, which increased by Rp139 bil compared to previous quarter. The increase is mostly due to decline in interest expenses from Rp2,552 bil in previous Q to Rp2,246 bil (decline of Rp306 bil), mostly due to increase in Current Account Deposit. Net interest margin improved from 53% to 57%. Well done !!!

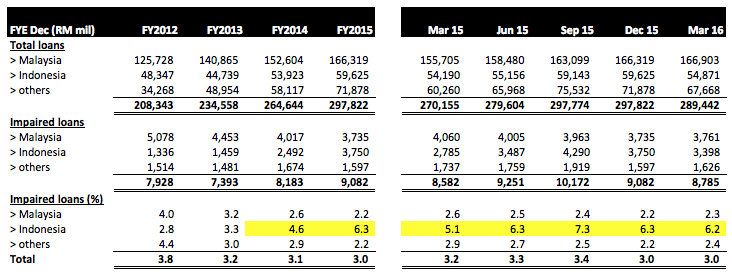

(c) The other major contributor is lower impaired loans provision, which resulted in saving of Rp120 bil. This is the second consecutive month of decline, after peaking in December 2015 quarter.

Provision is expected to continue to decline in coming quarters as CIMB CEO hinted in a recent interview that he expects second half of 2016 to perform better. Please refer to my previous article for details.

(d) Operating expenses increased by Rp25 bil. This was a negative surprise. After the mid 2015 Mutual Seperation Scheme, I expect cost to come down, not go up. Anyway, it is not a big issue as the increase is not really that big.

3. Earning Forecast

In my previous article, I have guarded feelings for the CIMB Group. I sensed that they are turning around, but was not sure when the recovery will actually take place. However, with CIMB Niaga announcing a reasonably good set of results yesterday, I have turned much more positive towards the group.

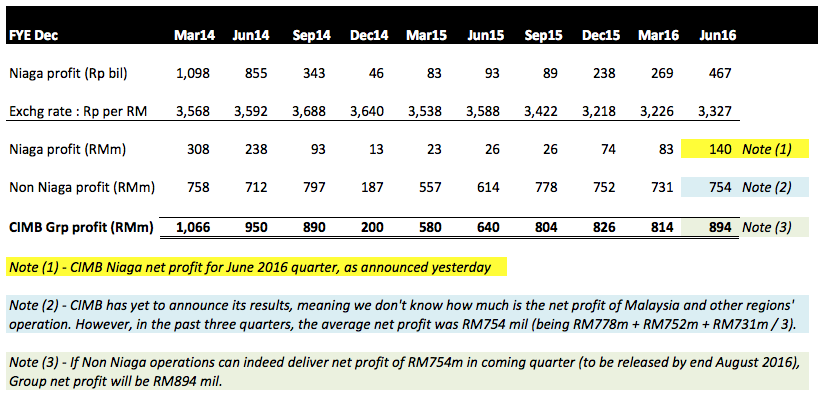

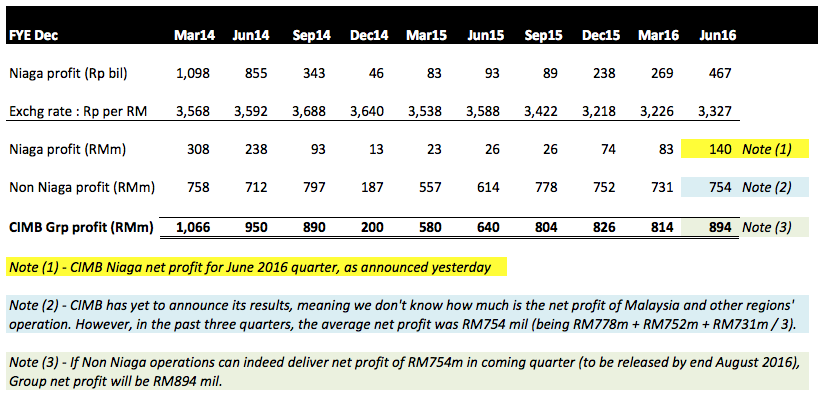

Armed with this new piece of information, I set up a financial model to try to feel the CIMB Group's coming quarter result.

Many people frown upon building financial model to predict future earning. Garbage in garbage out, if you get your assumptions wrong, your prediction will be way off.

However, in this particular case, there is sufficient ground for making such an attempt - the performance of CIMB's non Niaga operation has been fairly stable. In the past three quarters, it has generated net profit of RM778 mil, RM752 mil and RM732 mil respectively. I believe there is reasonable chance that the coming quarter will be more or less the same.

By putting together the above information, the model estimates that coming quarter net profit will be approximately RM894 mil.

But how should we interprete this figure ? What is the implication on valuation ? In other words, what should be the Target Price ?

4. Target Price

I previously set a Target Price of RM5.20 for the stock. That was plucked from the air based on my entry cost of RM4.29 and expected return of 20%.

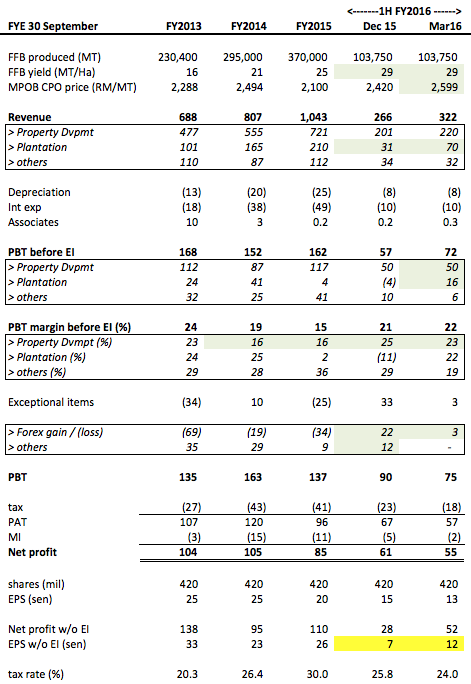

However, now that I have a better feel of the Group's positive momentum, I am happy to revise it upwards. For inspiration and guidance, I looked back to early 2014 when CIMB was still doing well.

As shown in the diagram above, CIMB traded at RM7.30 based on quarterly profit of RM1.066 bil in March 2014. The coming quarter of RM894 mil predicted net profit, if materialised, will be approxmimately 84% of its March 2014 quarter profit.

By applying 16% discount to RM7.30, I arrived at revised Target Price of RM6.13 for CIMB over the next 12 months.

This represents potential upside of 40% over latest closing price of RM4.39.

5. Concluding Remarks

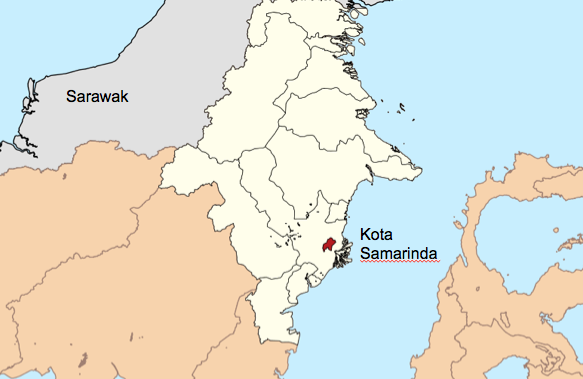

(a) Among all the banking stocks, I believe CIMB has the best long term growth potential. This is because of the relatively high weightage of its Indonesian operations. Indonesia's GDP per capita is still low and its population is huge. The country will conitnue to grow at a brisk pace for many years to come, dragging CIMB along with it.

(b) The Group's past 12 months performance was disastrous. Its exposure to Indonesia became a big liability, dragging down its overall profitability as Indonesia floundered under the tremendous downward pressure caused by collapse of commodity prices.

(c) However, this weakness has now become its strength. From investing point of view, CIMB has bigger upside potential compared to other banking stocks such as AFG, Public Bank, Hong Leong Bank, BIMB, etc, which have done reasonably well operationally.

(d) With the Indonesian economy now gaining strength, I believe we have reached an inflexion point for CIMB. The risk and reward ratio going forward looked favorable. It is time to stop sitting on the fence.

Buy lah, wait for what ?

Yesterday, CIMB Niaga released its June 2016 quarterly report. There was marked improvement in results. Net profit increased by 74% Q-o-Q.

(Press release spinned it as 318% increase Y-o-Y. However, I think Q-o-Q is more reflective of its latest earning momentum)

2. Results Analysis

(a) Compared with previous quater, net profit increased by 74% to Rp467 bil.

(b) One of the major positive contributor is Net Interest Income, which increased by Rp139 bil compared to previous quarter. The increase is mostly due to decline in interest expenses from Rp2,552 bil in previous Q to Rp2,246 bil (decline of Rp306 bil), mostly due to increase in Current Account Deposit. Net interest margin improved from 53% to 57%. Well done !!!

(c) The other major contributor is lower impaired loans provision, which resulted in saving of Rp120 bil. This is the second consecutive month of decline, after peaking in December 2015 quarter.

Provision is expected to continue to decline in coming quarters as CIMB CEO hinted in a recent interview that he expects second half of 2016 to perform better. Please refer to my previous article for details.

(d) Operating expenses increased by Rp25 bil. This was a negative surprise. After the mid 2015 Mutual Seperation Scheme, I expect cost to come down, not go up. Anyway, it is not a big issue as the increase is not really that big.

3. Earning Forecast

In my previous article, I have guarded feelings for the CIMB Group. I sensed that they are turning around, but was not sure when the recovery will actually take place. However, with CIMB Niaga announcing a reasonably good set of results yesterday, I have turned much more positive towards the group.

Armed with this new piece of information, I set up a financial model to try to feel the CIMB Group's coming quarter result.

Many people frown upon building financial model to predict future earning. Garbage in garbage out, if you get your assumptions wrong, your prediction will be way off.

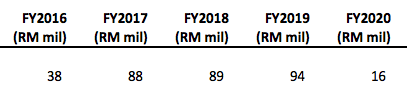

However, in this particular case, there is sufficient ground for making such an attempt - the performance of CIMB's non Niaga operation has been fairly stable. In the past three quarters, it has generated net profit of RM778 mil, RM752 mil and RM732 mil respectively. I believe there is reasonable chance that the coming quarter will be more or less the same.

By putting together the above information, the model estimates that coming quarter net profit will be approximately RM894 mil.

But how should we interprete this figure ? What is the implication on valuation ? In other words, what should be the Target Price ?

4. Target Price

I previously set a Target Price of RM5.20 for the stock. That was plucked from the air based on my entry cost of RM4.29 and expected return of 20%.

However, now that I have a better feel of the Group's positive momentum, I am happy to revise it upwards. For inspiration and guidance, I looked back to early 2014 when CIMB was still doing well.

As shown in the diagram above, CIMB traded at RM7.30 based on quarterly profit of RM1.066 bil in March 2014. The coming quarter of RM894 mil predicted net profit, if materialised, will be approxmimately 84% of its March 2014 quarter profit.

By applying 16% discount to RM7.30, I arrived at revised Target Price of RM6.13 for CIMB over the next 12 months.

This represents potential upside of 40% over latest closing price of RM4.39.

5. Concluding Remarks

(a) Among all the banking stocks, I believe CIMB has the best long term growth potential. This is because of the relatively high weightage of its Indonesian operations. Indonesia's GDP per capita is still low and its population is huge. The country will conitnue to grow at a brisk pace for many years to come, dragging CIMB along with it.

(c) However, this weakness has now become its strength. From investing point of view, CIMB has bigger upside potential compared to other banking stocks such as AFG, Public Bank, Hong Leong Bank, BIMB, etc, which have done reasonably well operationally.

(d) With the Indonesian economy now gaining strength, I believe we have reached an inflexion point for CIMB. The risk and reward ratio going forward looked favorable. It is time to stop sitting on the fence.

Buy lah, wait for what ?